The puzzle of Saturday, July 13th is far from complete, but the pieces are sorted. Something closer to a coherent picture is shaping up.

The most glaring issues have been defined: utter failure on the part of US Secret Service (USSS) and local law enforcement. Strange interaction between USSS and Thomas Crooks prior to the failed attempt. Donald Trump's team denied extra security prior to the event. Strange statements made in the days prior, such as Joe Biden uttering that Trump needed to be "put in the bullseye". Nonsensical explanations afterward, such as USSS head Kim Cheatle claiming that a nearly flat roof was too sloped to risk placing an agent there.

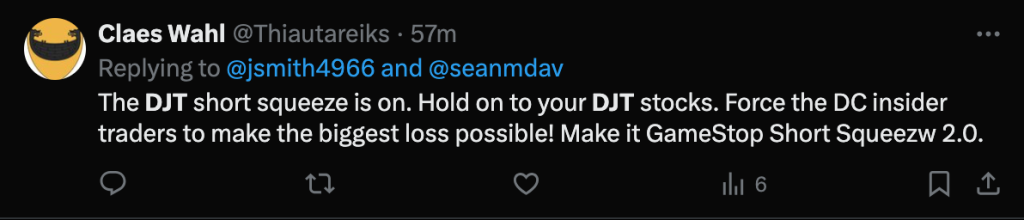

Now for some rigor around the numbers. What happened in financial markets before and after the assassination attempt? Three things stick out. First, as sleuths on X such as @DiedSuddenly have pointed out, short selling on DJT, the NASDAQ symbol for the Trump Media & Technology Group (TMTG), skyrocketed the day before Trump was shot.

Shorting a stock is an option trade. A trader borrows shares and sells them, hoping the price will fall afterward so they can buy them back for a lower price. Doing so just before a calamitous event suggests foreknowledge of said event. The last example most Americans remember was the lead-up to 9/11, when the volume of short selling on airlines American and United spiked. The profiteers were never identified.

TMTG has been the victim of market manipulation before the assassination attempt, according to Truth CEO Devin Nunes. A former congressman from California, Nunes took the reins at TMTG in January 2022.

Nunes has been fighting on multiple regulatory fronts since April to prove his allegations of naked short selling of DJT stock. Naked shorting is the illegal practice of shorting a stock without first borrowing the corresponding shares. Nunes points to atypically large and repeated trades that resulted in failures to deliver, or FTDs.

Nunes' fight--involving Congress, FINRA, and a handful of large hedge funds--is a difficult one. He has sought congressional influence to force FINRA to share trading data over several weeks from April 29 to June 3 in order to prove his allegations. He is also in a war of words with the hedge funds he suspects of naked short selling. One of those funds is the behemoth Citadel Securities, run by Ken Griffin.

In an uncharacteristically acidic tone, Citadel Securities replied to Nunes' comments, as reported by InvestorPlace.

“Devin Nunes is the proverbial loser who tries to blame ‘naked short selling’ for his falling stock price. Nunes is exactly the type of person Donald Trump would have fired on The Apprentice. If he worked for Citadel Securities, we would fire him, as ability and integrity are at the center of everything we do.”

Given that such accusations are usually ignored entirely by large banks and hedge funds, Citadel Securities' reply comes off as juvenile and defensive, not buttoned-up and corporate. The term "loser", casual mention of reality TV, then a quick pivot to how Citadel Securities is all about integrity...the optics are less than optimal. Doth the hedgie protest too much?

Regardless, the flurry of short selling activity one day before the assassination attempt ought to bolster and lend more credibility to the Nunes side of the argument, and possibly cast a darker shadow on Citadel Securities and others.

Several investigations are underway in the House and Senate. Homeland Secretary Alejandro Mayorkas is a character of primary interest, as is USSS head Kim Cheatle. Of some interest will surely be the USSS agents in the very building Crooks climbed on top of, and the photo one agent took of Crooks prior to the deadly shooting.

Among the leaders of the various investigations: House Homeland Security Committee Chair Mark Green (R-TN), Oversight Committee Chair James Comer (R-KY), and Intelligence Committee Chair Mike Turner (R-OH). For more detail on the congressional investigations, see reporting here by Axios.